Shares in Tesla have risen after the electric car maker reported its fifth consecutive quarterly profit.

The California-headquartered company has overcome disruptions caused by the COVID-19 pandemic to post a 39.2% increase in third-quarter revenues to $8.77bn (£6.68bn) from a year ago.

Tesla said it was on track to deliver half a million vehicles in 2020, but has admitted that the goal had “become more difficult” because of the impact of coronavirus.

The Nasdaq-listed firm reported a 215% jump in pre-tax profit of $555m from the same period last year.

Earlier this month, Tesla said it produced a record 145,036 vehicles in the third quarter and delivered 139,300 vehicles.

The company said it can achieve its targets by ramping up production of its mid-size seven seater Model Y – as well as its four-seater sedan Model 3 – at its Shanghai factory.

Tesla has defied the downward trend of the wider auto industry this calendar year with a 44% increase in global deliveries for the quarter.

The company bucked an economic upheaval, even as US auto sales overall fell 9.7% from a year ago due to consumer fears about the economy hit hard by the pandemic.

Tesla also overtook Toyota to become the world’s most valuable car company, despite the Japanese company manufacturing and producing more vehicles.

And its fifth consecutive quarterly profit puts it on track to report its only annual profit since its founding in 2003.

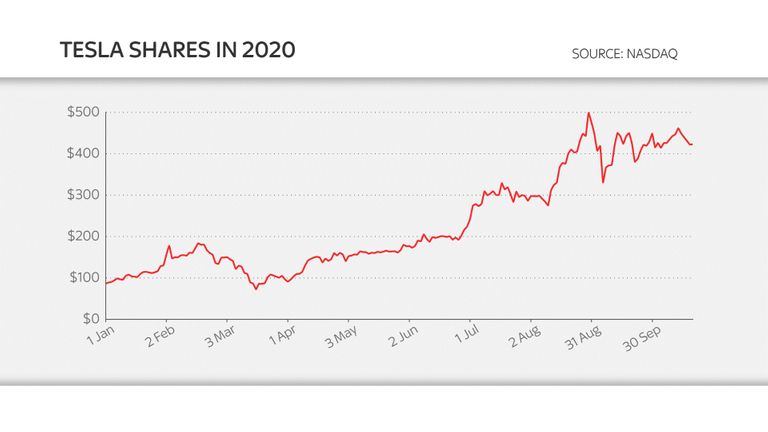

Tesla’s stock has been one of the market’s best performers this year, up nearly 400% year-to-date.

Despite the meteoric rally, Tesla, although eligible, was excluded from being listed in the prestigious S&P 500 stock index.

Questions have been raised about the way Telsa achieves profitability, as a major portion of it comes from selling regulatory credits to other carmakers.

Tesla earns regulatory credits from governments around the world for manufacturing zero-emissions vehicles and sells these to other car manufacturers that produce vehicles that run on petrol and diesel. Telsa reported that $397m of its revenues were derived in this manner for the third quarter.

Its share price had been on a downward trajectory since chief executive Elon Musk presented the company’s new battery technologies and manufacturing strategies at the company’s battery day event.

The outlook from carmaker’s senior executives at the event was cautious – explaining that the new developments wouldn’t be ready for a number of years.

Rival General Motors has also announced the launch of its battery-powered Hummer pickup truck that it plans to begin selling in about 12 months.

The Hummer EV is expected to go 350 miles or more on a full charge – in line with Tesla’s top models.